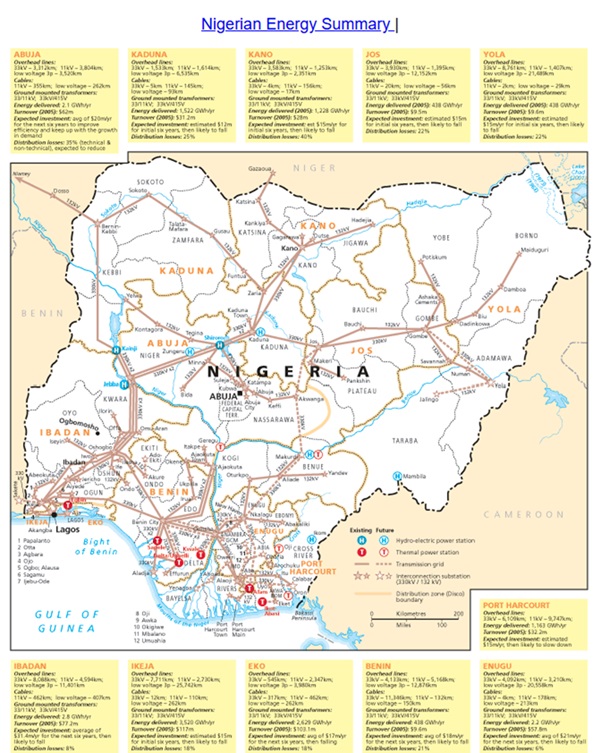

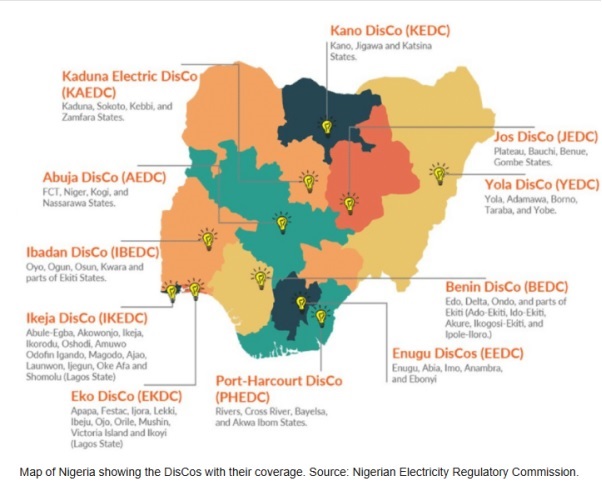

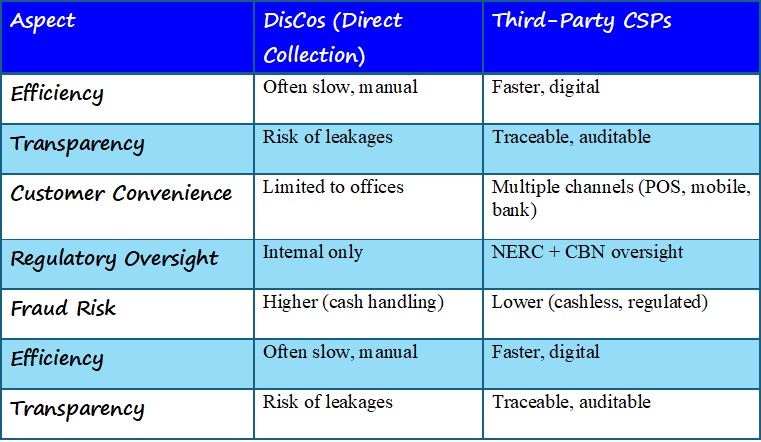

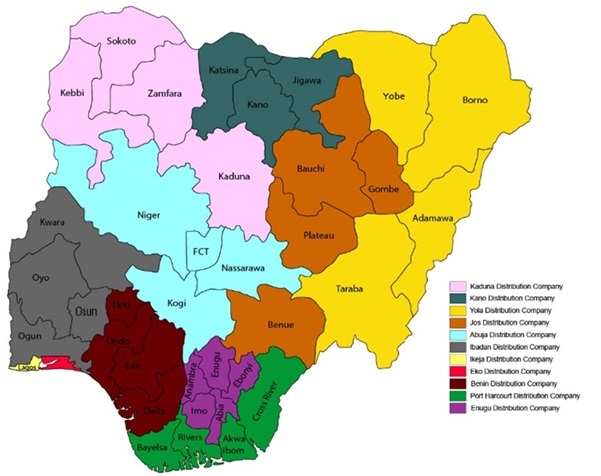

Geographical Spread of the Nigeria Electricity Distribution Companies

10 December, 2025 at 10:00

Nigeria’s electricity supply system was originally divided into 11 Distribution Companies (DisCos) under the Electric Power Sector Reform Act of 2005. Each company was assigned responsibility for specific states and regions across the country. With the introduction of the Electricity Act of 2023, both private companies and state governments are now permitted to participate in electricity distribution. Taking advantage of this new opportunity, Aba Power Limited Electric (APLE) began operations in 2024, making it the 12th electricity distribution company in Nigeria.

Below is the geographical coverage of all 12 DisCos across the nation.

11 Earlier Distribution Companies: Source: https://nbet.com.ng/distmap.html

Abuja Electricity Distribution Company (AEDC) is responsible for electricity supply across Central Nigeria, covering the Federal Capital Territory (FCT), Niger, Kogi, and Nasarawa States. It currently serves over 1.29 million registered customers in these areas.

Maintenance man at work

Benin Electricity Distribution Company (BEDC) is responsible for electricity supply across Southern Nigeria, covering the states of Edo, Delta, Ondo, and Ekiti. It manages a large service area and provides power to over 1.46 million registered customers as of Q1 2025.

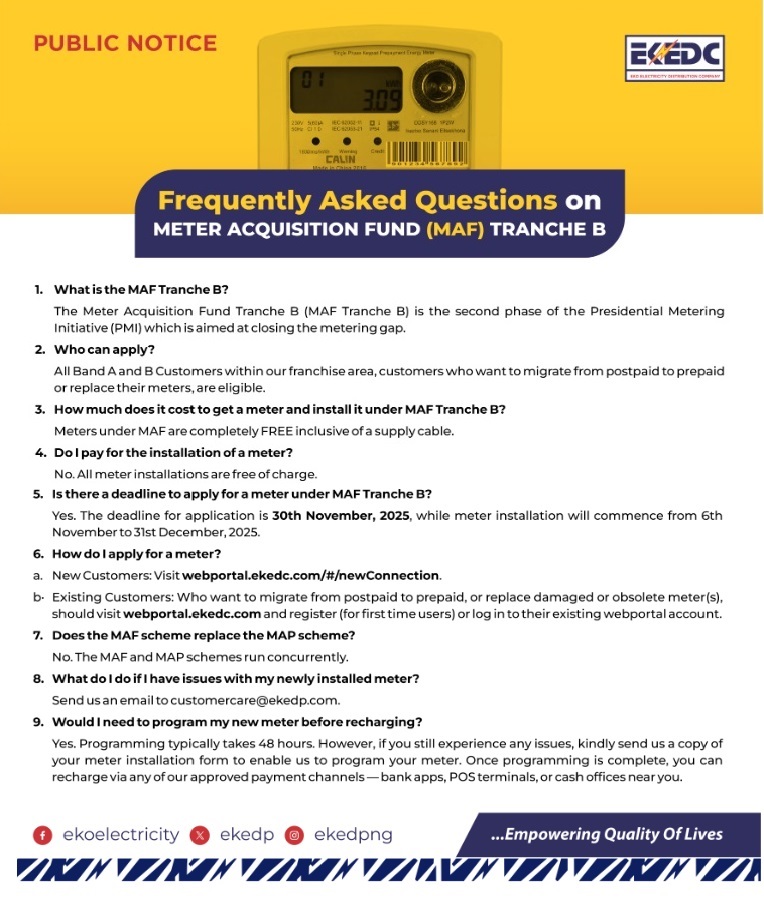

Eko Electricity Distribution Company (EKEDC) manages electricity supply across Lagos South (including Ojo, Festac, Apapa, Lekki, and surrounding areas) as well as parts of Ogun State. It is one of Nigeria’s largest power distributors, serving about 752,974 registered customers. Key service areas include Lekki, Ibeju, the Islands, Ajah, Ajele, Orile, Ijora, Apapa, Mushin, Festac, Ojo, and Agbara (Ogun State).

Enugu Electricity Distribution Company (EEDC) is responsible for electricity distribution across the five states of Southeast Nigeria: Enugu, Abia, Imo, Anambra, and Ebonyi. As of Q1 2025, it serves over 1.39 million registered customers in this region.

Maintenance Officer fixing a broken conductor

Ibadan Electricity Distribution Company (IBEDC)operates across Southwestern Nigeria, covering Oyo, Ogun, Osun, Kwara, and parts of Ekiti and Kogi States. It is Nigeria’s largest power distribution company, serving over 2.69 million registered customers as of Q1 2025.

Ikeja Electric (IKEDC)supplies electricity to major districts in Lagos State, including Ikeja, Agege, Ikorodu, Abule Egba, Akowonjo, Oshodi, Apapa, Lekki, and Shomolu. It is one of Nigeria’s largest electricity distributors, with over 1.31 million registered customers as of Q1 2025.

Jos Electricity Distribution Company (JEDC)is responsible for electricity distribution in Central Nigeria, covering Plateau, Bauchi, Benue, and Gombe States. It serves approximately 857,562 registered customers.

Kaduna Electric (KAEDC)operates in Northwestern Nigeria, supplying power to Kaduna, Sokoto, Kebbi, and Zamfara States. It has about 889,146 registered customers.

Electricity Distribution maintenance men at work

Kano Electricity Distribution Company (KEDC)supplies electricity across Northern Nigeria, covering Kano, Jigawa, and Katsina States. It serves approximately 887,554 registered customers.

Port Harcourt Electricity Distribution Company (PHEDC)operates in Southern Nigeria, providing electricity to the states of Rivers, Cross River, Bayelsa, and Akwa Ibom. It serves over 1.17 million registered customers.

Yola Electricity Distribution Company (YEDC)is responsible for electricity distribution in Northeastern Nigeria, covering Adamawa, Borno, Taraba, and Yobe States. It serves about 824,693 registered customers.

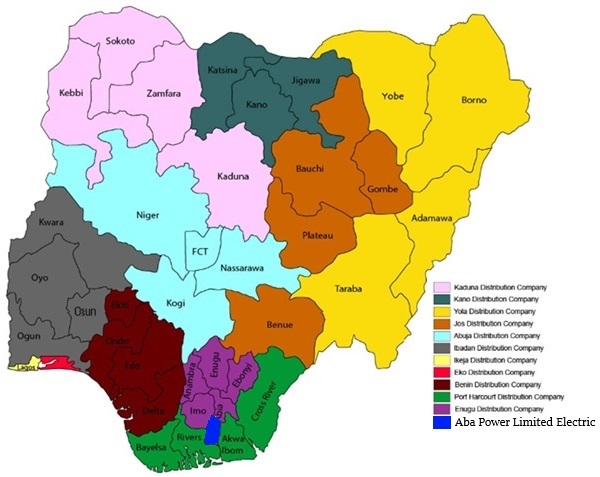

Aba Power Limited Electric distribution network. Source: https://geometricpower.com/aple/

Aba Power Limited Electric (APLE)runs Nigeria’s first independent electricity distribution network, located in the Aba Ring‑Fence Area (ARFA). It is part of the Aba Integrated Power Project, which is connected to the 141 MW Geometric Power Plant.

Nigeria 12 Electricity Distribution Companies including Aba Power Limited Electric/

Under its license, APLE supplies electricity to 9 out of 17 Local Government Areas (LGAs) in Abia State, serving 210,911 registered customers as of Q1 2025.

Next Article